Understanding Superbills and Out-of-Network Insurance

- Out-of-Network Insurance: Understanding the Basics

- Eligible Plans and Checking Out-of-Network Coverage

- The Importance of Understanding Your Coverage

- Superbills: What Are They and How Are They Used

- How Superbills Are Submitted: Streamlined Steps

- Insurance Reimbursement & Superbills at Thriving Center of Psychology

Navigating the healthcare system can sometimes feel like deciphering a complex puzzle, especially when it comes to understanding out-of-network insurance and superbills. This article aims to demystify these concepts, what out-of-network insurance entails, including eligible plans and how to check for out-of-network coverage as well as providing a clear understanding of what superbills are, how they are used and submitted.

Out-of-Network Insurance: Understanding the Basics

Out-of-network insurance refers to coverage provided for services received from providers who do not have a contract with your insurance company. These services typically cost more than those received from in-network providers, but depending on your insurance plan, a significant portion of these costs can be reimbursed once you’ve met your out of network deductible.

Eligible Plans and Checking Out-of-Network Coverage

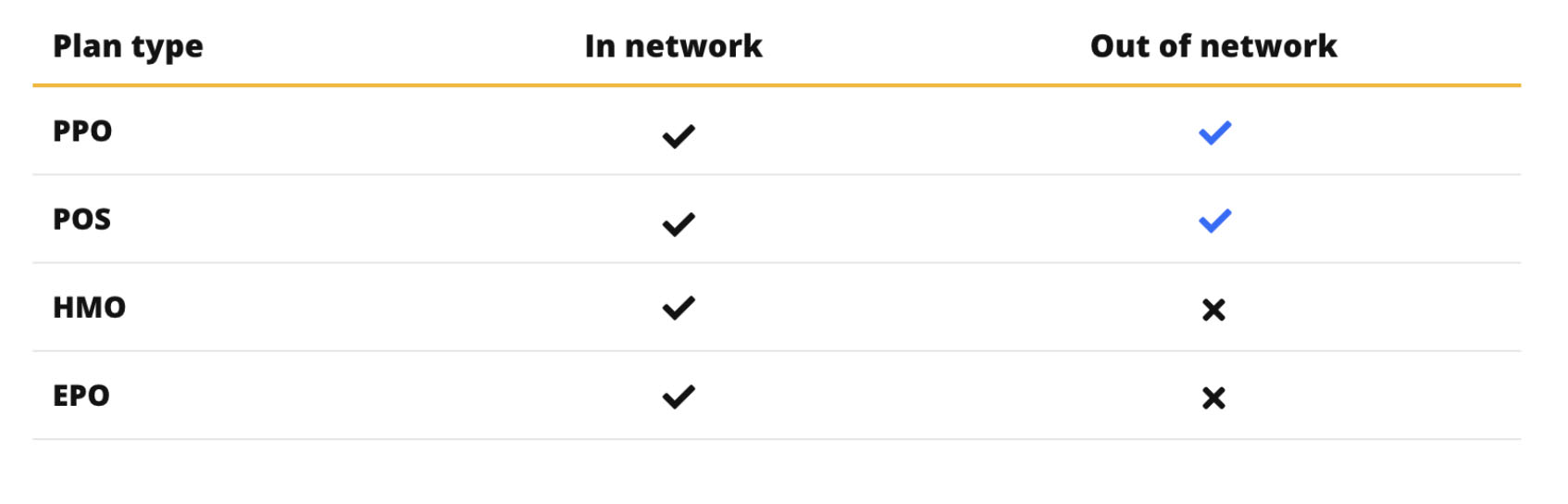

Not all insurance plans offer out-of-network benefits. Plans that commonly provide such benefits include Preferred Provider Organization (PPO) and Point of Service (POS) plans. In contrast, Health Maintenance Organization (HMO) and Exclusive Provider Organization (EPO) plans usually do not cover out-of-network services. Depending on your health insurance plan, eligibility for reimbursement typically ranges from 50% to 80% of our appointment fees once the out of network deductible amount has been met.

To check your out-of-network coverage:

- Review Your Insurance Policy: Your policy document will have detailed information on whether out-of-network services are covered and to what extent.

- Contact Your Insurance Provider: Reach out to the member services number located on the back of your insurance card and request to speak with the Benefits Department. Inquire specifically about your coverage for Mental Health Outpatient Visits in an office setting, without testing. Should they ask for specific billing codes, provide them with the appropriate code(s).

- 90791 – Psychiatric Diagnostic Evaluation (intake session, individuals only)

- 90834 – 45 minute psychotherapy session (follow-up sessions, individuals only)

- 90847 – 45 minute Family psychotherapy, conjoint psychotherapy with the patient present (Couples or Family therapy)

- Online Account Access: Many insurers provide online portals where you can access detailed information about your plan, including out-of-network coverage.

The Importance of Understanding Your Coverage

Knowing the details of your out-of-network coverage is crucial. It helps you make informed decisions about seeking healthcare services and preparing for potential out-of-pocket expenses. Understanding your insurance plan’s specifics, such as the percentage of costs covered and the deductible amount for out-of-network services, is vital in managing your healthcare finances effectively.

Superbills: What Are They and How Are They Used

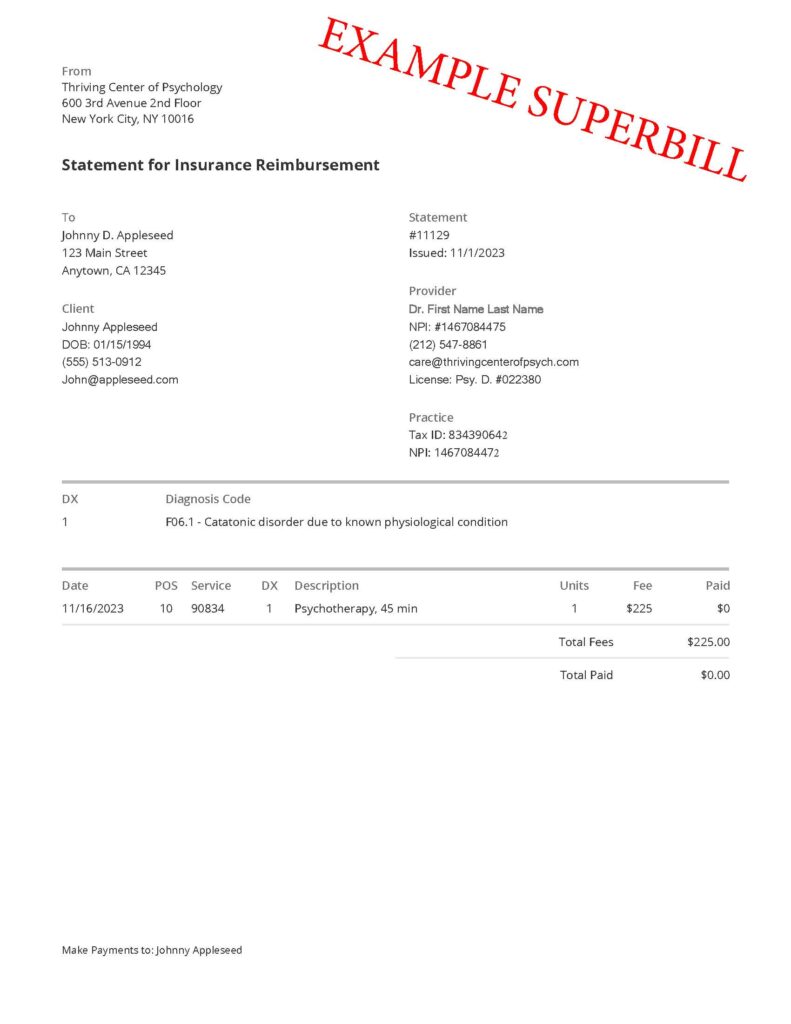

A superbill is essentially a detailed invoice provided to patients by healthcare providers after receiving out-of-network services. Unlike a standard receipt, a superbill contains comprehensive medical information necessary for insurance claims. This includes:

- The provider’s full details (name, address, and contact information).

- The patient’s personal and insurance information.

- Date of service and detailed descriptions of the services provided.

- Procedure codes (CPT codes) that represent specific health services.

- Diagnosis codes (ICD-10 codes) that categorize the patient’s health condition.

Superbills are crucial for patients who visit out-of-network providers and wish to seek reimbursement from their insurance companies. They serve as the bridge between the healthcare provider and the insurance company, ensuring that patients have all the necessary information to file a claim.

How Superbills Are Submitted: Streamlined Steps

Submitting a superbill for insurance reimbursement has become more accessible, thanks to electronic submission processes and third-party assistance. Here’s how you can effortlessly handle your superbill submission:

- Review the Superbill: Quickly check your superbill for accuracy and completeness. This is an important step to ensure your claim is processed smoothly.

- Utilize Electronic Submission: Most insurers now offer convenient online platforms for submitting claims. This typically involves uploading your superbill and any additional required documents digitally, making the submission process quick and efficient.

- Fill Out Additional Forms(if Needed): Sometimes, your insurer may require additional forms. These are usually downloadable from the insurer’s website and can be submitted electronically along with your superbill.

- Consider Third-Party Assistance: For an even easier submission process, services like Reimbursify offer to handle the submission for you for a small fee. They specialize in managing healthcare reimbursement claims, simplifying the process for patients. This can be a great option if you’re looking for extra assistance and convenience.

- Follow Up on Your Claim: Keep track of your claim’s status, typically available through your insurer’s online portal. If further information is needed, be prepared to respond promptly to your insurance company’s requests.

By leveraging electronic submission methods and possibly third-party services like Reimbursify, managing your superbill submission becomes a hassle-free experience, allowing you to focus on your healthcare needs.

Insurance Reimbursement & Superbills at Thriving Center of Psychology

At Thriving Center of Psychology, the process for providing superbills is tailored to support clients in their journey toward mental wellness, while also acknowledging the complexities of insurance reimbursements. Here’s an overview of their comprehensive procedure:

- Out-of-Network Policy Reminder: Thriving Center of Psychology is an out-of-network provider with all insurance plans. This means the practice does not handle preauthorizations and cannot confirm eligibility or benefit coverage directly.

- Client Responsibility in Insurance Communication: Patients are encouraged to independently verify their out-of-network benefits. This involves contacting their insurance provider, which can be done by calling the member number on the back of the insurance card and connecting with the Benefits Department. The focus should be on confirming eligibility for Mental Health Outpatient Visits in an office setting, specifically for services without testing.

- Providing Essential Billing Codes: For patients who require them, the Thriving Center provides crucial billing codes (CPT codes)These codes are necessary for insurance companies to identify the nature of the services provided. Below are the codes Thriving Center uses.

- 90791 – Psychiatric Diagnostic Evaluation (intake session, individuals only)

- 90834 – 45 minute psychotherapy session (individuals only)

- 90847 – 45 minute Family psychotherapy, conjoint psychotherapy with the patient present (Couples or Family therapy)

- Monthly Superbill Generation: The Center generates superbills on the 1st of every month. This regularity ensures that patients have timely access to the documents necessary for insurance claims.

- Secure Access to Superbills: Patients are invited to access their superbills through the Thriving Center of Psychology’s secure client portal. This ensures privacy and ease of access.

- Comprehensive Information on Superbills: Each superbill includes all information required for insurance reimbursement. This includes the patient’s name, date of service, clinician’s name, diagnosis code (DX code), CPT/billing code, session rate, the practice’s tax ID, and other relevant details.

- Submitting Superbills for Reimbursement: Patients are instructed on how to submit their superbills for reimbursement. This can be done through their insurance company’s portal/profile or via fax, email, or traditional mail to the insurance’s Claims Department.

- Empowering Patients: By providing clear instructions and the necessary documentation, Thriving Center of Psychology empowers patients to navigate the reimbursement process with their insurance providers effectively.

Navigating superbills and out-of-network insurance can be straightforward with the right guidance. Understanding these elements is key to confidently managing your healthcare journey. At Thriving Center of Psychology, we simplify this process, focusing on your therapeutic progress while ensuring a smooth financial path.

Start your journey with us for a therapy experience that’s both healing and hassle-free. Our dedicated team is ready to match you with the ideal therapist for your unique needs. Embrace wellness with Thriving Center of Psychology — View our providers here, book an appointment online or call our office today, and let us make your path to healing a supported and rewarding experience.

Understanding Impostor Syndrome: Breaking Free from Self-Doubt

Imposter syndrome can make you feel like a fraud with no confidence in your abilities. You’re not alone; so many people feel like this. The good news is that you can break free from imposter syndrome and overcome self-doubt; here’s how.

Supporting a Loved One with Mental Illness: Practical Tips and Resources

There isn’t one perfect way to support a loved one with mental illness. How you care for someone will depend on you and the person you support. Mental illness can affect all aspects of a person, from mood to behavior. It can come as a shock when a loved one is diagnosed with a mental illness.

Is My Relationship One-Sided?

Do you feel like you’re doing all the work in a relationship? When a relationship is one-sided, it can create stress and conflict. If one partner invests more energy and effort to make the relationship work, it creates an imbalanced dynamic that can be draining in the long haul.

How To Recover From Burnout?

Manageable and short-term stress can increase alertness and give you the focus to hit a tight deadline. But left unchecked, chronic stress can result in burnout, leading to complete physical, mental, and emotional exhaustion.